Investors set to return to reliable earnings and dividends

It has been an eventful few months for UK equity investors. Since my last newsletter, Jeremy Hunt, the second new chancellor in as many months, has reversed almost all the measures tabled by his predecessor, Kwasi Kwarteng, in September’s ‘mini-budget’. This return to prudence has restored an element of confidence in UK markets. In addition, in the face of high inflation, the Bank of England has increased the base rate by a further 0.75% to 3.0%. All this comes on top of two new Prime Ministers and a new monarch.

Against this backdrop, readers might be surprised to hear that we are more optimistic about investing in the UK than we have been for some time. The UK has more judicious political leadership, and a more constructive approach towards harmonising fiscal and monetary policy. The pound, having almost hit parity against the dollar in September, has recently settled in the 1.15 to 1.20 range, yet arguably remains undervalued. And most significantly of all, UK companies are generally in good shape and appear more attractively valued than many overseas equities.

The era of abundant capital is over

For the last decade, up until the start of 2022, rock-bottom interest rates created an era of abundance in which high-growth and even loss-making stocks could flourish. With a sustained low cost of debt and equity, investors tolerated low returns on high rates of capital expenditure in the expectation of growth. The focus was firmly on capital appreciation, with income marginalised. Many investors were drawn to US and global growth stocks, often overlooking high-quality, British dividend-paying companies.

However, conditions have shifted dramatically, requiring investors and companies to adapt. Increasingly, companies that fail to keep costs, debt and capital expenditure under control are coming under greater scrutiny. Investors in ‘US tech’ have experienced this first-hand in recent months. Closer to home, former highflyers are also struggling whilst dependable dividend growth stocks seem be returning to favour.

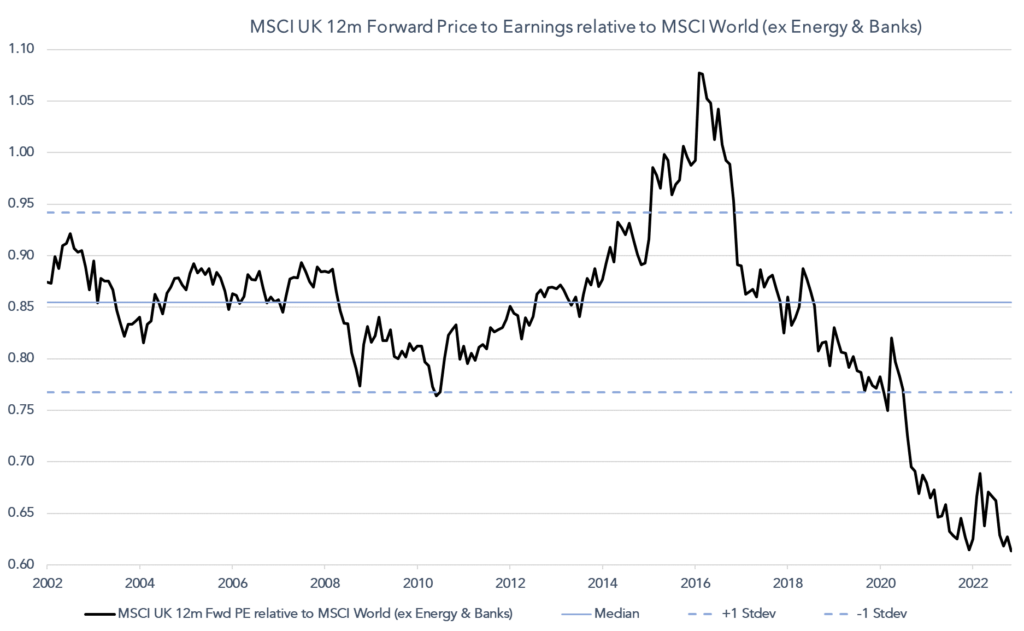

As I wrote in my last newsletter, most of this year’s share price falls have been in response to falling company valuations rather than falling earnings. While we think there remain portions of valuation risk1 left in global markets, we think the UK finds itself in a comparatively stronger position as a result of meaningful valuation discount2:

Source: Troy Asset Management / MSCI / FactSet, 31 October 2022. Energy and banks excluded as Troy does not currently invest in these industries.

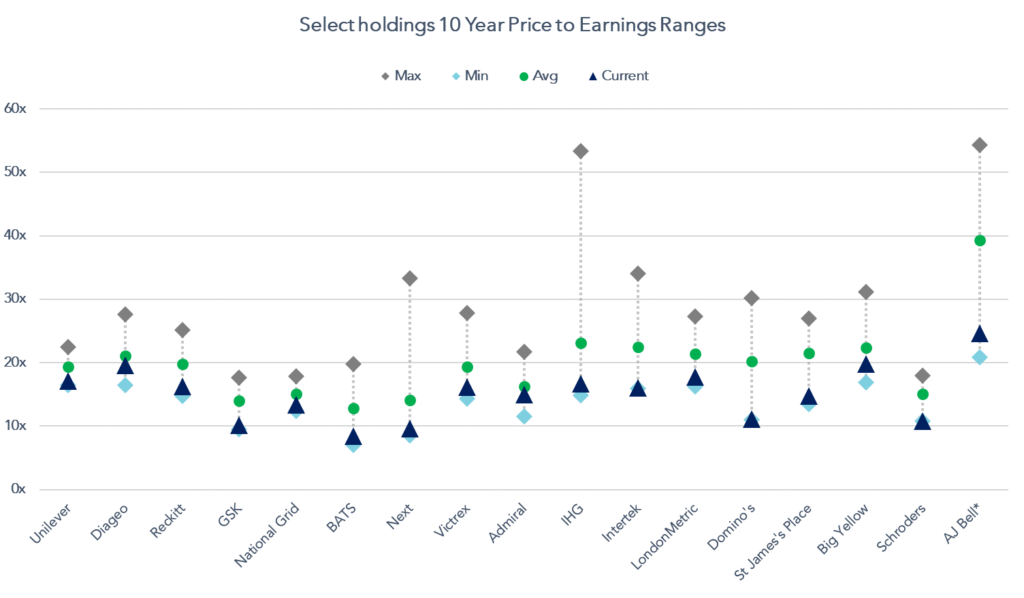

We find the same pattern within our UK portfolios. The below chart shows those names that are currently trading at the low end of their price to earnings (P/E) range. These companies collectively account for almost half of our holdings and notably represent a wide range of profiles and industries.

Source: Bloomberg, 31 October 2022. Not representative of all holdings in portfolio.

Portfolio earnings – reassuring strength

It is widely expected that we will see weaker earnings in the coming year, and the latest round of corporate earnings is already highlighting pockets of weakness in the broad equity market. However, so far we are reassured by the defensive and stable trends shown by the core holdings in your Fund. This operational defensiveness has always been central to our investment process. We have been quietly impressed by our global consumer staples companies. While volumes will come under greater pressure in 2023, the evidence suggests so far that Unilever, Reckitt Benckiser, Diageo, Nestlé, and Procter & Gamble, have managed to raise prices rationally and successfully in order to control their cost base.

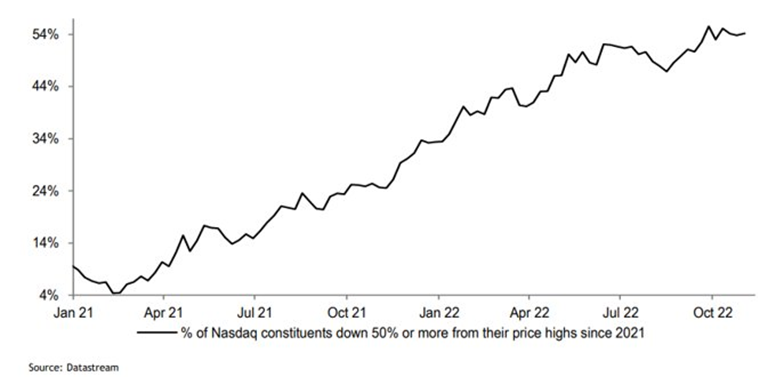

As numerous headlines attest, broadly defined ‘tech’ has had a difficult year. At the end of October, more than half of companies in the NASDAQ index had suffered a share price decline of over 50%!

Source: Datastream, 31 October 2022

However, the Fund’s dividend-paying software and data investments, such as RELX and Paychex, have fared much better, with both anticipating steady sales and earnings growth to continue in the coming months. These are large, established, highly profitable businesses. While cash will be a constraint for many companies in this era of higher rates, our holdings can be expected to continue re-investing their significant free cash flow for growth while funding sustainable dividends.

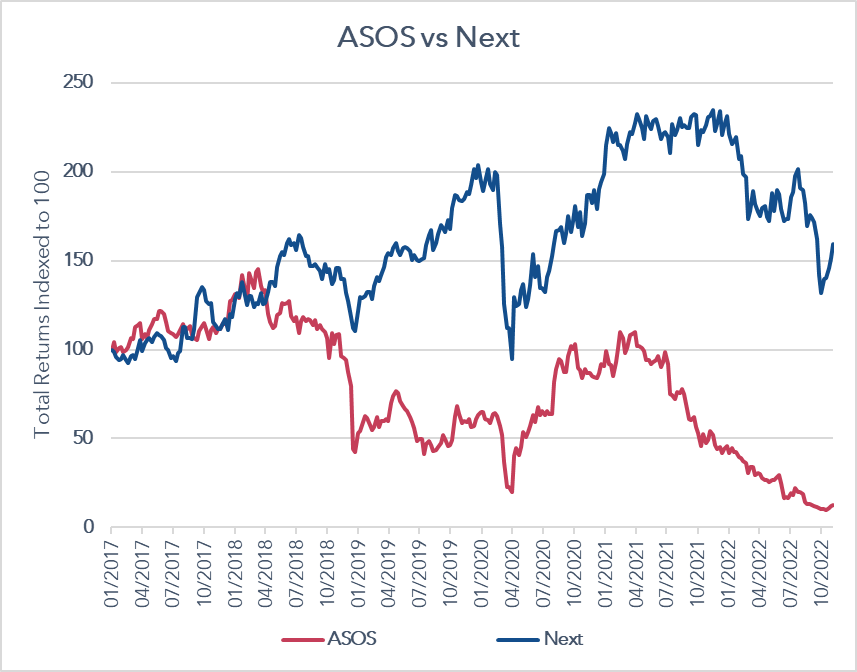

Time for incumbents to prosper

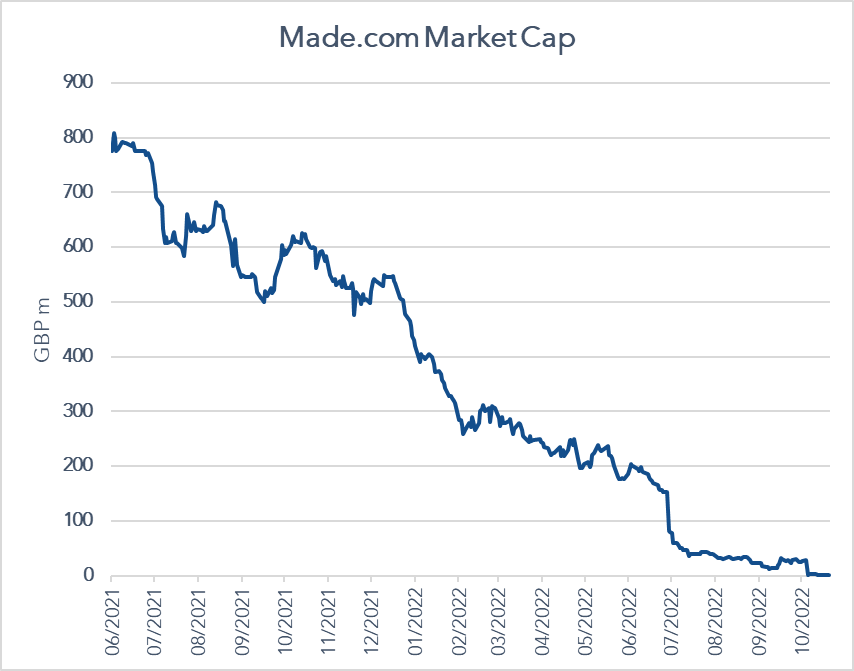

After many years in which it has been all about ‘disruptors’ and new business models displacing the old, we believe the balance is slowly swinging back in favour of strong incumbents. Launched in 1982 but with roots that date back to the 19th century, NEXT plc is a classic ‘incumbent’ company that has stood the test of time. Today it seems that online focused peers such as Made.com and ASOS are struggling to sustain and invest in their businesses, with the former recently going into administration. In contrast, NEXT has continued to adapt and produce consistently good results. Over the last 40 years, it has proven to be one of the most resilient UK retail companies and has built a formidable and highly profitable online business. In a particularly telling sign of the times, it has recently been announced that Next will buy Made.com’s brand, domain names and intellectual property for £3.4m. It was little over a year ago that Made.com listed with a market cap of c.£800m.

Source: Factset, 31 October 2022.

Source: Factset, 31 October 2022.

NEXT is just one of many leading ‘incumbents’ within Troy portfolios that we expect to not only survive but prosper over the decades to come. With interest rates having risen, the cost of debt and equity capital is now notably more expensive than it has been for many years. This will act as a meaningful headwind for those ‘disruptive’ companies that rely on external financing to sustain themselves. Now is the time of the ‘incumbent’.

A more positive outlook for UK equities

So amidst all the drama, there are several reasons to be more optimistic about investing in UK equities. After a ‘near-death experience’, the government has regained a handle on public expenditure. UK markets have found some poise, but in our view remain excellent value. And after ten years of being overshadowed in favour of exciting, rapid growth companies, we think it is time for solid, reliable UK dividend growth investments to shine again.

1 The risk that a company is overvalued.

2The deficiency in value that a buyer estimates for a company compared to its peers in the same industry.

Please refer to Troy’s Glossary of Investment terms here. Fund performance data provided is calculated net of fees unless stated otherwise. Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. Investments in mid and smaller cap companies are higher risk than investments in larger companies. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the fund’s price, as at the date shown. The yield is not guaranteed and will fluctuate. It does not include any preliminary charge and investors may be subject to tax on their distributions.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Derivatives (whose value is linked to that of another investment, e.g company shares, currencies) may be used to manage the risk profile of the fund.

Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. The fund(s) is/are registered for distribution to the public in the UK only. The fund(s) is/are available to professional investors only in Ireland.

The distribution of shares of sub-funds of Trojan Investment Fund (“Shares”) in Switzerland is made exclusively to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Qualified Investors can obtain the prospectus, the key investor information documents or, as the case may be, the key information documents for Switzerland, the instrument of incorporation, the latest annual and semi-annual report, and further information free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, CH-1204 Geneva, Switzerland, web: www.carnegie-fund-services.ch. The Swiss paying agent is: Banque Cantonale de Genève, 17, quai de l’Ile, CH-1204 Geneva, Switzerland.

The offer or invitation to subscribe for or purchase shares in Singapore is an exempt offer made only: (i) to “institutional investors” (as defined in the Securities and Futures Act, pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore, as amended or modified (the “SFA”); (ii) to “relevant persons” (as defined in Section 305(5) of the SFA) pursuant to Section 305(1) of the SFA, and where applicable, the conditions specified in Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018; (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the SFA; or (iv) pursuant to, and in accordance with the conditions of, any other applicable exemption provisions of the SFA.

All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2022. ‘FTSE ®’ is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence. Morningstar logo (© 2022 Morningstar, Inc. All rights reserved.) contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. The fund described in this document is neither available nor offered in the USA or to U.S. Persons.

Copyright Troy Asset Management Ltd 2022.