“But as well as the science, we need to get the economics right. That means first we must have continued economic growth in order to generate the wealth required to pay for the protection of the environment. But it must be growth which does not plunder the planet today and leave our children to deal with the consequences tomorrow.

Margaret Thatcher, UK Prime Minister, 8th November 1989, speech to the United Nations General Assembly.

And second, we must resist the simplistic tendency to blame modern multinational industry for the damage which is being done to the environment. Far from being the villains, it is on them that we rely to do the research and find the solutions.”

In the previous Income Matters, we outlined why we believe our approach to investment continues to make sense in a changing world. As we move towards an environment characterised by structurally higher interest rates and inflation, potentially less globalisation, increased capital expenditure and a return of wage bargaining power, it is little wonder that we are witnessing what looks like the end of a 40-year bull market in Government bonds. This is a significant change and some might argue one’s investible universe should change as a result. (We disagree as outlined in Income Matters 5). This piece explores another notable change – the greater focus given by investors to a company’s environmental footprint and its relationship with all stakeholders.

Navigating another kind of regime change

Changing government and consumer attitudes have altered the expectation of companies’ role in society. We have seen a proliferation of new reporting frameworks, taskforces and sustainability accounting standards that companies have had to navigate over the recent past. These all point to a clear trend; there is increased pressure to measure and report on the ways in which a company’s operations, products, and services depend on, and interact with, both people and the planet. From reporting on carbon emissions and virgin plastic use, to health and safety metrics and employee turnover, greater transparency is being demanded of corporates.

But isn’t this just business analysis?

We have long sought to consider and analyse intangibles that create long-term value and see no reason why material environmental and social factors should be treated any differently. This has followed a natural evolution at Troy. As the availability of data on environmental and social factors has improved, our analytical framework for appraising businesses has also adapted.

Attributes we may consider include the strength of a company’s brand, customer satisfaction rates, employee productivity, management competence, the stewardship of natural resources and R&D capabilities. These factors are all instructive of the durability of a company’s competitive advantages and its long-term cash flow generating capabilities. Just as we have long accepted that other intangibles are an important component of business analysis, the consideration of material environment, social and governance (ESG) factors shouldn’t be separated from this process. This is also the reason that Troy’s investment analysts and fund managers remain fully responsible for ESG integration. Concentrated portfolios, low turnover and a long-term ownership mentality allow us to dig deep beneath the surface of the companies in which we invest.

Sustainable value creation

Sustained long-term value creation is rarely borne out of playing zero-sum games. Experience has taught us that well-managed and properly governed companies tend to be far-sighted, closely aligned with their stakeholders and better able to navigate change. These are often also companies that have been able to sustain high returns on invested capital over time and create long-term value for shareholders. They recognise that their licence to operate is closely linked with their behaviour as a responsible corporate citizen, and consequently act with broader social and environmental considerations in mind.

Our research of Nintendo illustrates this point well. Nintendo is a prominent Japanese video game company founded in 1889 known for developing several iconic gaming franchises and consoles. We first invested in Nintendo in March 2021. This is a company whose culture and approach to employee welfare has supported its innovation and creativity. The issue of ‘crunch culture’, when developers work long hours under stressful conditions ahead of the release of a new game to meet a deadline, is endemic in the gaming industry. This practice is synonymous with overwork, low morale and burnout.

Nintendo, unlike many of its competitors, has a history of delaying games to protect their integrity and preserve the essence of ‘fun’ in game creation. This is not only important for making better games, it also enhances Nintendo’s ability to attract and retain talented developers. These are the subtleties that we believe lead to sustained value creation over longer time horizons that are often overlooked in traditional financial analysis.

Where we see opportunities for improved value creation, we may seek to engage with a company. This is an integral part of our stewardship responsibilities. We have largely been able to leverage our long-standing relationships with management teams to set ourselves up for constructive and fruitful engagements, which we believe allows for a higher likelihood of achieving our desired objectives. We engage on a wide range of issues, as illustrated in Figure 1.

Figure 1 – 2023 Year-to-date, 13 engagements with 10 companies

Source: Troy Asset Management Limited, 30 September 2023.

There’s no such thing as a free lunch

At Troy, as part of our company research we aim to understand the political, legal and regulatory environment that our companies operate in. We are therefore always mindful of the ways in which changes in regulation or political regimes can impact the profitability of the businesses we invest in.

It is undeniable that the world is beset by many complex ecological and welfare problems, many of which feel more pressing today than ever. We anticipate that the expectation of businesses to manage their environmental footprint and respond to societal challenges will carry on as governments continue to display more interventionist policies and the flow of information via social media and elsewhere continues to enhance the scrutiny of business’ conduct. This again is simply part of understanding business risk, which is critical for any investor.

The adaptability and resilience of business models

Business risk is often most pronounced when companies have not had to internalise the costs they may have imposed on society or the environment. Capitalism, despite the many ways in which it has been a force for good in the world, has simultaneously under-costed externalities along the way. Over long enough time horizons, regulators often seek to correct these inefficiencies and with that comes both risks and new opportunities.

A frequently cited example is that of carbon emissions. Businesses have historically found it more advantageous to pollute rather than pay for the cost of emitting directly. As the climate continues to change, we are reminded of the physical ramifications that await us. Not only is the world predicted to see more extreme weather events which could impair physical assets, we are also facing the prospect of longer-term fundamental changes in our ecosystems and water cycles which will impact food systems, water and natural resource availability and the human capital that depend on them.

The types of companies we favour are those that are sufficiently financially productive to invest behind potential problems. They also have management teams who appreciate the commercial benefits of transitioning to a low carbon economy. Fastenal provides a good example. Fastenal specialises in the sale of industrial products including fasteners, tools and safety supplies. While the company itself is not very carbon intensive, its industrial customers are facing increased pressure to reduce their emissions. If Fastenal as a supplier can facilitate its customers’ sustainability needs, this will likely further entrench its position in the value chain.

When we began looking across the portfolio, in early 2021, to identify companies without a climate strategy, Fastenal was one of the laggards. The company was under increased pressure from customers to develop a decarbonisation strategy and offer more environmentally friendly solutions. Troy engaged with Fastenal, including meeting senior executives, to encourage it to provide better reporting and stronger governance on climate as well as to set decarbonisation goals. Fastenal have been front-footed in their response; our engagement was concluded as successful earlier this year as the company announced its commitment to net zero. Today Fastenal offer approximately 53,000 ‘green products’, including more than 12,350 certified products as well as 40,600+ environmentally preferred products made from textiles, plastics or even packaging with better environmental credentials1.

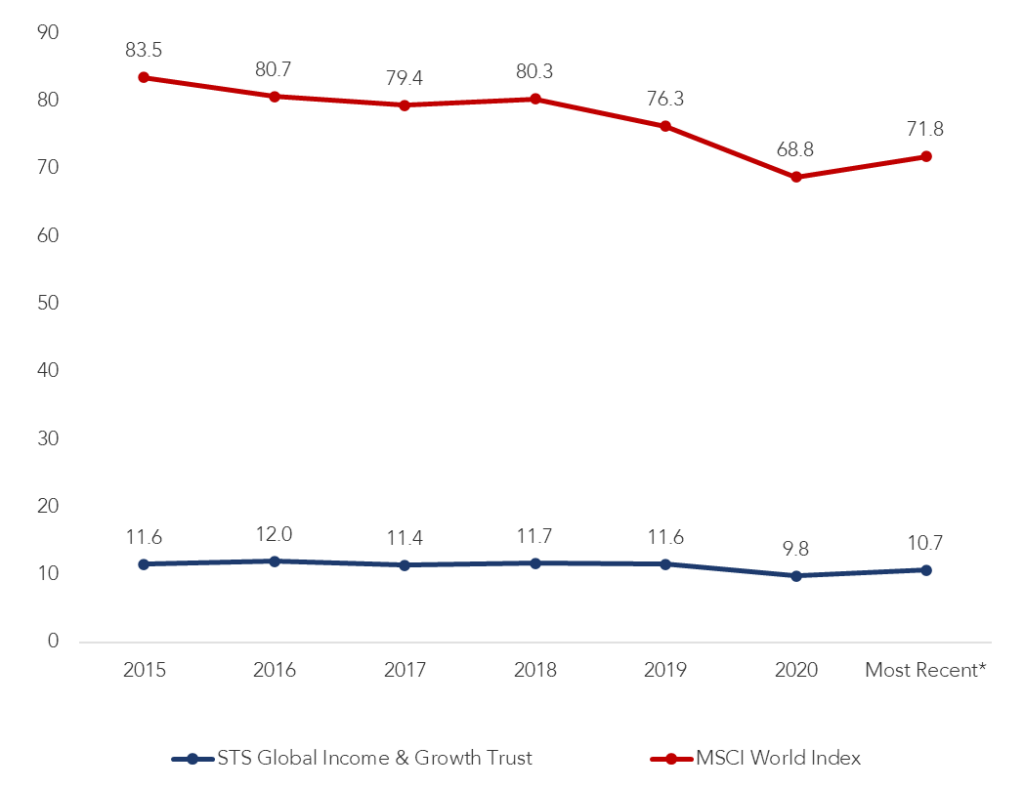

Our exposure to high-impact sectors, i.e., those with a higher carbon footprint, remains limited given our bias towards capital-light and non-cyclical businesses. The Strategy has a carbon footprint 85% lower than the MSCI World Index, see Figure 2. This goes some way in managing the portfolio’s exposures to carbon-risk. However, we remain mindful of the fact that all businesses have a role to play in the transition that lies ahead. All but three companies in the portfolio have set a net zero target, and we have a constructive engagement underway with CME Group, Texas Instruments and Nintendo, the three companies that are yet to set a net zero target.

Figure 2 – Carbon footprint of current equity holdings (TCO2E/US$M invested)

*Reflects the most recently available data for each company prior to 30 September 2023. Source: MSCI ESG Manager, Troy Asset Management Limited, 30 September 2023. The reference to benchmarks is used for comparative purposes only.

Iteratively getting better

Accepting that we can always do better is what drives innovation and human ingenuity. We believe that the best companies strive towards iterative improvements across all dimensions of business performance, including those that pertain to environmental and social impacts. This is a critical component of what it takes to stay competitive and not only helps mitigate risks but also offers new opportunities, as illustrated in the case of Fastenal.

We aim to remain grounded in pragmatism and common-sense and accept that the degree to which ESG issues can materially impact a businesses’ financial health vary depending on the industry, geography, size of the business and products or services it sells. There is no such thing as one size fits all, we are therefore selective of which factors we pay attention to and will always ground our discussion in individual business risk and opportunity. The other component of materiality is time. Materiality will wax and wane over different economic and political cycles and our job is to remain alert to such changes.

A question we are often asked is how the Strategy’s investment in tobacco sits within our ESG framework. We are careful to balance risks against opportunities to achieve our objective of delivering above average returns with below average volatility. In doing so, it is not our role to be moral arbiters of our investors’ capital, we leave that decision to you.

Tobacco companies have historically been a favoured place for income investors, the income stream is high and reliable – these are defensive businesses supported by strong pricing power and reliable customer demand. Tobacco also provides exceptional value today. These attributes are particularly valuable in light of the current macroeconomic and geopolitical uncertainty we face. We believe that this combination of a highly financially productive business trading at an attractive valuation makes for an excellent global income asset.

Despite its controversy, the industry is iteratively getting better. Remarkably, the disruption has come from within, with Philip Morris as the trailblazer. Given the regulatory changes and increasing awareness about the health risks associated with traditional smoking, tobacco companies have adapted to evolving market demands by shifting their focus towards next-generation products (NGPs), such as electronic cigarettes, heated tobacco products, and nicotine pouches, designed to provide a potentially less harmful alternative to conventional cigarettes. The products offer smokers an alternative to the combustion of tobacco, reducing the exposure to harmful chemicals found in smoke by up to 95%.

A member of Troy’s Investment Team recently visited Philip Morris’ R&D centre in Neuchâtel, Switzerland. The company was the first to embark on the journey towards developing NGPs, underpinned by management’s vision of one day creating a smoke free world. The innovation and entrepreneurialism of Philip Morris is exemplary and is part of the fabric of their culture, observable at all tiers from the company’s headquarters, the R&D centre and manufacturing facility. With clear communication from management on the future direction of the company, Philip Morris have invested over $10 billion in R&D to create a portfolio of NGPs, and today is the market leader in heated tobacco with its IQOS franchise. IQOS comprises around a third of the company’s revenue and is growing as the company manages to convert additional smokers to a reduced risk alternative. The other tobacco companies are playing catch-up with Philip Morris who have successfully set the tone and direction for the wider industry to follow. This example serves as a further reminder of the importance of adaptability.

Quality matters

The importance of what we see as quality has been a recurrent message in all our Income Matters newsletters: a company that generates a good return on capital, has limited capital requirements, can reinvest for the future and can adapt to changing customer, environmental and societal demands. This creates resilience and makes them better placed to deliver strong shareholder returns, growing free cash flow and income over the long term.

On the 1st November 2023 it will be 7 years since the launch of the Troy Global Income Strategy. We are grateful to our investors for their support the Board for their guidance over this period. James Harries and Tomasz Boniek will be hosting a webinar on the 14th December 2023 at 10am to discuss the current backdrop and potential future opportunities.

1Fastenal. Fastenal define “Green Products” as being products which reduce negative effects on human health and the environment compared to competing products.

Please refer to Troy’s Glossary of Investment terms here. Performance data relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the investments will be met. Investment trusts may borrow money in order to make further investments. This is known as “”gearing””. The effect of gearing can enhance returns to shareholders in rising markets but will have the opposite effect on returns in falling markets. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation. Please note that the STS Global Income and Growth Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“”SEC””) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. © Troy Asset Management Limited 2023