The only constant is change

Some readers will have read our multi-asset team’s recent note on gold. While not directly relevant for the global income strategy – lack of yield being one of the defining features of gold after all – it did highlight just how much the investment backdrop is changing. The surge in the gold price is but the latest consequence of this, alongside the fall in the yen, the rise in the price of copper and the steepening (although not yet dis-inversion) of the yield curve.

The material re-pricing of fixed income markets across maturities reflects the reduction of support from central banks via quantitative easing, alongside a corresponding acceleration in fiscal spending; the US is running an unheard of 7% fiscal deficit in peacetime with full employment. When combined with a new age of insecurity, these developments are structural with implications which will unfold over years.

Into this heady mix, which under normal circumstances might have been expected to result in uncertain markets where the resilience of the portfolio would have been apparent, two disruptive innovations have appeared. This has driven big market moves as investors try to anticipate potentially profound but hard to forecast scenarios. These concern both the sudden mass adoption of AI and the invention of GLP-1 weight loss drugs.

In each case there is good reason to suggest that markets have done what they usually do, which is to overreact in the short term. While AI is likely to have huge implications, this will become apparent over years and in ways that are hard to foresee at this early stage. Equally, if weight-loss drugs are to have widespread and long-standing adoption, it is likely that they will come with some less desirable side-effects and off-setting negatives which only become apparent in time. This may reduce their effect on consumer behaviour. In each case our allocation to consumer staples (in the case of GLP-1s) and relatively limited direct exposure to technology (in the case of AI) has proven to be a significant drag on short term performance.

Seeing through a glass darkly

At times of great uncertainty, it is helpful to put things in context and anchor on what we can know rather than what we cannot. We know that the US equity market, on many long-term valuation measures, is as expensive as it has ever been with very few exceptions (1929, 2000 and 2021) and is more concentrated in a small number of companies than ever before. We know that the change in interest rates is the largest and fastest we have seen in 40 years and that the effect of such changes is typically apparent with a long and variable lag.

To us this suggests a cautious approach is warranted, and for those investors with irreplaceable capital and in need of income, the strategy continues to offer a growing, long term income stream together with capital growth.

Process over outcome

At Troy we invest in high quality businesses that have durable competitive advantages. These advantages, while not immutable, tend to afford companies an ability to sustain high rates of return on capital over long periods. The attractiveness of an investment therefore derives from the strength of the business model rather than the current market circumstances. This long-term timeframe is evidenced by the low turnover in our portfolios (c.10%), implying that we typically invest in companies for 10 years or so. This is longer than most economic and market cycles.

This leads us to concentrate our portfolios in particular sectors and companies that we think fit the bill. It also implies that there will be periods, potentially quite long periods, where our portfolios will perform very differently from the broader market and our peers. Indeed, managing a strategy that tends to protect when markets are weak implies that we will lag stronger market returns for reasonable periods of time. Sharp periods of outperformance have hitherto offset this leading to good long term risk-adjusted returns which is our aim.

We take comfort from two facts. First, that the same approach led to good risk-adjusted performance since inception as recently as August 2022 (a short time ago in investment terms); and second, that the competitive advantages of our portfolio companies remain intact and valuations have improved. We expect our companies to continue to compound capital on an underlying basis at attractive rates of return. We are confident that this in time will be recognised by the market, but we cannot control when.

So, what circumstances might herald a change?

This too shall pass

It is in the nature of investment that a confluence of events might conspire to render your portfolio out of favour. This certainly describes the last 18 months for the strategy. Our distinctive process and desire to be disciplined with regard to quality and valuation, has at this time led to us having several notable, differentiated and, yes, contrarian characteristics. Currently we have a material allocation to consumer staples, a substantial overweight to the UK market (on a listed rather than underling revenue basis) and a portfolio that we think will be robust in an economic downturn. Our underlying holdings show decent embedded value and also benefit from having limited capital requirements. We have correspondingly limited exposure to highly valued companies or those with industrial, consumer or financial cyclicality.

This positioning has however counted against us in recent times. Consumer staples have been hit by a combination of post-COVID normalisation and excessive GLP-1 related fears. The UK has suffered a politically inspired discount. Expensive assets have got more expensive still (as evidenced by sectors such as industrials). Cyclical concerns have been cast aside, for now at least, in the euphoria over AI and resultant capital expenditure boom (as evidenced by semi-conductor companies).

In terms of how events may unfold, the combination of elevated equity valuations, the possibility that rates may stay higher for longer and the prospect of an economic slowdown all make the broader market highly vulnerable to a derating. It is at such times that Troy’s approach comes to the fore as our emphasis on robust business models, combined with a disciplined approach to valuation, tends to limit the risk of drawdown.

Further, the disruption of COVID and the GLP-1 scare, appear to be passing into the rear-view mirror. This can be seen from recent results as well as the relative pick up in the performance of the consumer staples sector.

Additionally, the UK seems to be slowly emerging from the global capital market doghouse. It may be dawning on investors that the intense political psychodrama of recent years is drawing to a close and that the likely left-of-centre, but more stable government in waiting may provide a more predictable backdrop for investors. This is a better environment in which to make long term investment decisions. In turn, this may attract capital back to lowly valued UK assets, as evidenced by the uptick in M&A in the UK market.

The recent economic optimism that a global recession has been avoided may have reached a short-term zenith. As the fiscal stimulus and post-COVID savings in the US fade, but higher interest rates remain, unemployment may rise and economic activity fall. This would be much less surprising than current valuations and sentiment imply. We have not experienced an orthodox economic cycle, arguably, for 25 years and such an event has become unfamiliar. Perhaps this most normal occurrence will therefore come as a great surprise, with a correspondingly material effect on market valuations.

Finally, the AI capex wave may not last as long as investors appear to believe. In the dot-com boom, investing in the “picks and shovels” of the internet was a very popular, and at the time seen as a lower risk way of gaining exposure to this new phenomenon. We are seeing a very similar dynamic play out with AI. Whereas then it was servers and fibre, today it is semi-conductors, data centres and related companies. While the current expenditure is real, as evidenced by the stellar results of such companies as Nvidia, capital cycles can be over-extrapolated. If the deployment of AI in the real economy takes longer than many currently believe, returns on the current levels of investment may disappoint. Amara’s law states that we tend to overestimate the effect of technological change in the short term and underestimate it in the long term. We may look back at the current AI frenzy as a textbook example of this while acknowledging that it may take some time yet for this to become apparent.

Westward look, the land is bright

We continue to see equity markets as fully priced both relative to their own history and to fixed income. Further we observe speculative investor behaviour that echoes the 2021 peak. In contrast, we have a collection of high-quality businesses that we think combine attractive value and decent prospects that should deliver a dependable and growing level of income along with capital growth. Such an outcome should be largely independent of the macro backdrop, which could prove to be very valuable in the coming months.

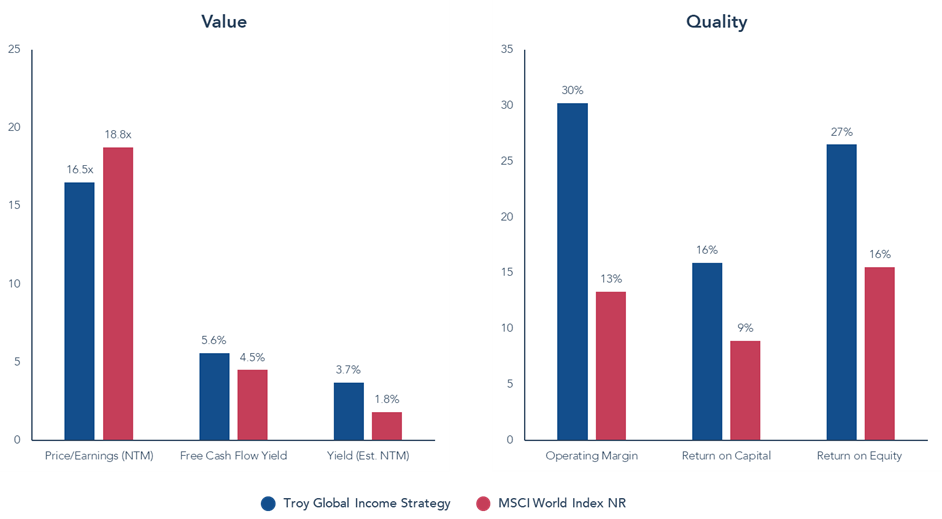

While there has been much that has fired investors’ imaginations recently, the gains enjoyed may not survive either slower than expected adoption of new technologies or earnings driven disappointment as the economy slows. Under both scenarios we are confident the portfolio is attractively valued and well positioned to deliver dependable returns (see Appendix 1). Appendix 2 provides a brief update on each of the portfolio’s top 10 investments.

APPENDIX 1

Source: FactSet, 30 April 2024. Past performance is not a guide to future performance. Characteristics are shown excluding banks. Free Cash Flow measures are based on estimates for the next 12 months. Forecasts are not a reliable indicator of future performance. All references to benchmarks are for comparative purposes only. Asset Allocation is subject to change. Yield is not guaranteed and will fluctuate. The information shown relates to a mandate which is representative of, and has been managed in accordance with, Troy Asset Management Limited’s Global Income Strategy.

APPENDIX 2

The top 10 holdings, which make up 46.3%1 of the portfolio, are as follows:

Paychex and ADP: Making up 5.2% and 4.3% of the portfolio respectively, these outsourced HR IT software companies are important and long standing investments of the strategy. Paychex has been held since launch while the investment in ADP was established during the COVID market decline. In the dynamic landscape of payroll and human capital management, ADP and Paychex stand out as pivotal players. ADP, renowned for servicing one in six private employees in the U.S., and Paychex, catering to one in twelve, demonstrate the combination of innovation and reliability in the industry which marks them out as core long term investments. Their robust growth in earnings and strategic positioning in the market – ADP with its diverse client base and Paychex excelling in the small business segment – underscore their strong industry positions. Both companies have demonstrated resilience and adaptability, navigating through economic cycles and maintaining healthy margins, a testament to their operational excellence and commitment to shareholder value.

Their consistent performance and ability to generate and return cash flow to shareholders align perfectly with the trust’s objectives of delivering stable and growing income. The trust’s strategy, focused on above-average returns with below-average volatility, finds a strong correlation in the business models of ADP and Paychex, which have proven to be both profitable and sustainable over time.

Unilever 5.2%: described recently by one of our research providers as “the most compelling turnaround in European staples”, we continue to like this business as a core long-term holding. Indeed, there is good reason to think that the company is embarking on a period of change to the benefit of shareholders. The new management team is re-invigorating the business in a manner similar to that undertaken by Procter & Gamble in 2015, which then went on to have a sustained period of good performance. This includes an internal restructuring to reduce complexity, a greater focus on the core brands as well as a change to incentives to encourage greater accountability and dynamism. They have also become more pro-active in managing the existing portfolio, both via the sale of Elida Beauty (a collection of beauty and personal care brands) and recently and more importantly the divestment, either by sale or spin-off, of their ice cream business.

In this way the management team expects to be able to expand margins as well as increase organic growth in the business. This is happening at a time when the shares are very attractively valued. Better operational execution should, in time, drive better performance from the shares.

Pepsico 4.9%: this company dominates the global savoury snack market and ranks as the second largest beverage provider globally behind Coca-Cola. As such, it benefits from repeat-purchase affordable luxuries that leads to brand loyalty and related pricing power. The company has gone through several years of elevated investment, leaving it primed to begin to reap the benefits of this capex programme. The international business, which represents c.40% of sales is gaining scale to the benefit of margins and profitability. Brands include Pepsi, Mountain Dew, Gatorade, Lay’s, Cheetos, and Doritos. While well established in core markets such as the US and UK, the propensity for snacks to become a larger part of overall food consumption is still building elsewhere giving the company a long runway for growth.

CME Group 4.9%: this company operates exchanges that allows investors, suppliers and businesses the ability to trade futures and derivatives based on interest rates, equity indices, currencies, energy, metals and commodities. The company benefits from the increased volatility across asset classes in a world of less supportive Central Bank policy as well as the increasing desire and need for pools of capital to hedge risk. It further benefits from the expansion of debt markets associated with the elevated levels of fiscal spending that has become the favoured tool of policy makers to boost demand. The shares pay an attractive regular dividend as well as a special each year of all surplus cashflow making for a valuable return balance between income and capital.

British American Tobacco (BAT) 4.4%: the combination of resilient cash flows and a compelling valuation form the basis of our investment case in BAT. The business is well diversified from a geographical standpoint. That allows the company to continue growing even if some regions suffer setbacks. While volume trends in the US market have been weak, we would expect this to normalise at some point and in the meantime can be offset by raising prices. BAT has also embarked on a shareholder value initiative by reducing its stake in ITC, an Indian fast moving consumer goods company. The proceeds can be used to both buy back stock and reduce debt. It is likely BAT has also suffered from being listed in the UK which has been very out of favour with investors. A reversal of this would help the shares.

Microsoft 4.3%: the core Office and Azure businesses are showing strong revenue growth driven partly by AI. Their product designed to help subscribers to deploy AI across the Microsoft software suite, named “Copilot”, has driven revenue per user growth. Further, AI-based expenditure on infrastructure will benefit the Azure business for some time to come. This is well understood by the market as indicated by the valuation of the shares but reminds us of the powerful competitive advantages that this company continues to enjoy and which are arguably strengthening.

RELX 4.4%: this company is a global provider of information-based analytics and decision tools for professional and business customers in various industries. The company serves sectors such as science and medical research, risk management, and legal. In addition, RELX organises large-scale digital and face-to-face events, such as industry trade shows. Around 60% of revenue is generated in North America and about 20% in Europe. AI is allowing the company to shift further to analytics and decision tools which has boosted growth. As the scale player the company is hard to compete against. Perennial fears that their proprietary academic data will have to be provided for free have proved unfounded. In turn, the consistent growth of free cash flow has allowed for excellent shareholder returns through both dividends and share buy backs.

Philip Morris (PM) 4.3%: with the leading global heat-not-burn brand, IQOS, PM has stolen a march on its peers. This position in next generation products has been strengthened via the acquisition of Swedish Match by adding the Zyn brand which is a popular traditional oral tobacco product. As tobacco companies morph from sellers of cigarettes to a range of less harmful nicotine consumer products, the companies are becoming more sustainable. Returns on capital and capital allocation are excellent allowing for very resilient shareholder returns.

Reckitt Benckiser 4.4%: this company has suffered for two sharp falls in the share price recently. This is the result of sub-optimal execution but also, frankly, bad luck. The shares fell once following the disclosure of under-declared volume rebates in the Middle East and again when a jury in Illinois found Mead Johnson, Reckitt’s infant formula business, negligent in failing to warn of the risks of premature infants developing necrotizing enterocolitis (NEC) having consumed infant formula. It would seem the jury confused correlation with causation but despite that, Mead Johnson is likely ultimately to have to agree to a settlement. This will be dictated by the number of cases and the scale of the compensation. While the numbers are uncertain, it is likely to be considerably less than the loss of value implied by the fall in the share price.

Meanwhile, Reckitt Benckiser is a well-financed business that operates in categories that have strong brands affording pricing power and an excellent margin structure. It is very cash generative and enjoys decent market shares. The shares are now excellent value.

1 As at 30th April 2024. Asset allocation and holdings subject to change.

Please refer to Troy’s Glossary of Investment terms here. Performance data relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the investments will be met. Investment trusts may borrow money in order to make further investments. This is known as “gearing”. The effect of gearing can enhance returns to shareholders in rising markets but will have the opposite effect on returns in falling markets. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation.

Please note that the STS Global Income and Growth Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training.

© Troy Asset Management Limited 2024.