“I have a plan for growth, to topple the current ‘business as usual’ managerial approach to the economy and put more money back into the pockets of hardworking people.”

Elizabeth Truss, ex-UK Prime Minister, Twitter, 6th August 2022

“Everyone has a plan until they get punched in the face.”

Attributed to Mike Tyson

Goodbye Blue Sky

As a global investor sitting in the UK there have been times in the last few weeks when one has had to rub one’s eyes to make sure what seemed to be unfolding was really happening. In quick time we have seen a wholesale repricing of interest rates here and elsewhere more profound than many (including ourselves) believed possible. As the foundational price on which all other asset prices depend such a large and adverse movement is a dramatic capital market event.

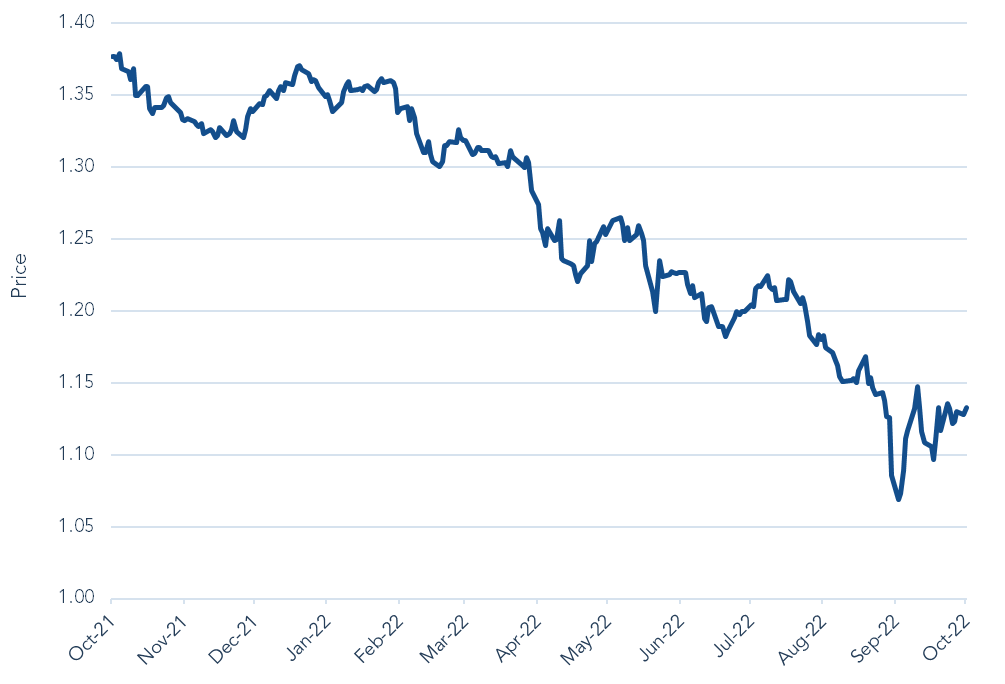

Figure 1: US Yield Curve now vs 1 year ago

Source: Bloomberg, 24 October 2022. The yield curve plots the interest rates of bonds having equal credit quality but differing maturity dates. The yield curve (also called the 2-10 spread) has dramatically flattened and inverted.

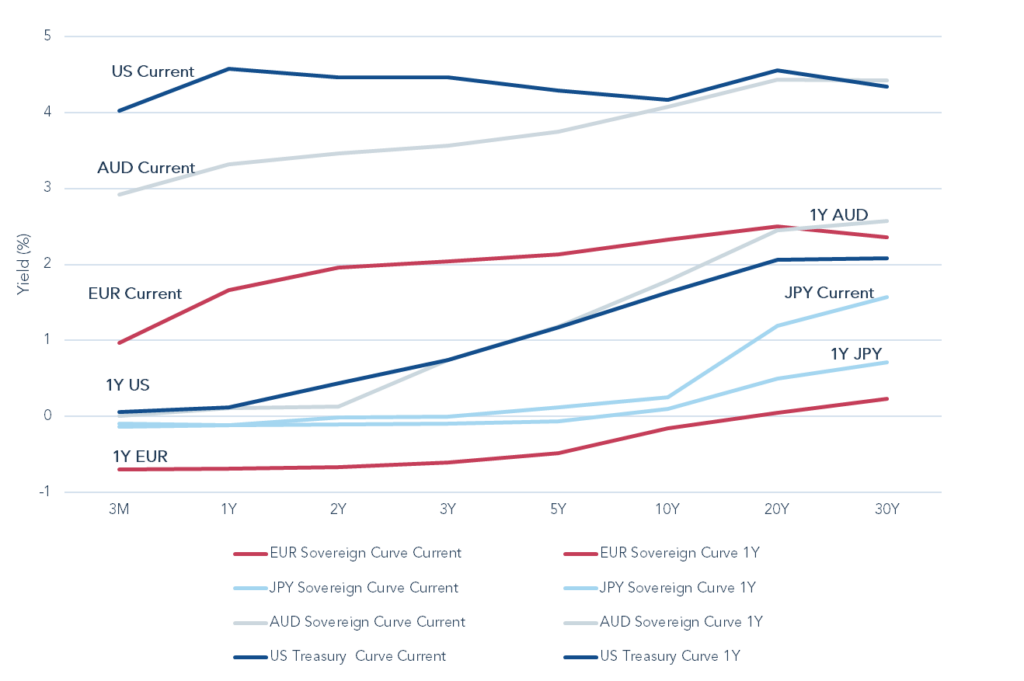

We have also seen substantial currency moves with notable US dollar strength.

Figure 2: Sterling vs US Dollar

Source: Bloomberg, 24 October 2022.

Interest rates matter and to have seen such a material move is shocking. They matter in three key ways: as an input into company interest costs, as a driver of consumption across the economy as the increased cost of borrowing takes demand from elsewhere and, as Warren Buffett put it, “interest rates are to valuations what gravity is to the apple”. Given that asset prices are derived from the discounting of future cash flows a rising discount rate, all else equal, will lead to lower prices.

In short, rapidly rising interest rates is bad news for capital markets even if the beleaguered saver can finally enjoy some return on cash. However, this return is still well below the current rate of inflation.

Time will tell if reverberations continue to be felt in other markets, as we fear. So far, given the scale of the move, both equities and credit have been surprisingly measured even within the context of widespread falls in the most speculative areas.

While the problems in the UK are particularly acute, they are not unique. What we are experiencing here is also being felt elsewhere even if without such a loaded political environment – although the migration to the outer reaches of the political spectrum is also not isolated to the UK. Our own leaders do seem to have managed to score an own goal though by making a difficult situation worse. Rates are going up across the globe but owing to the recent “mini-budget” the situation has been more pronounced. This has led to the blame becoming attached to our politicians in a way that is not the case elsewhere to the same degree.

Even while acknowledging this, the problems in markets are global.

Figure 3: Government Bond Yield Curves Today vs one year ago

Source: Bloomberg, 24 October 2022. The yield curve plots the interest rates of bonds having equal credit quality but differing maturity dates. The yield curve (also called the 2-10 spread) has dramatically flattened and inverted.

Figure 4: Euro and Australian Dollar vs US Dollar

Source: Bloomberg, 24 October 2022.

Figure 5: Yen vs US Dollar

Source: Bloomberg, 24 October 2022.

This rate shock is in addition to the exogenous shocks of the war in Ukraine and the lingering effects of COVID.

What we are seeing is the reality of the capital markets waking up. Government spending that is not financed from taxation has to be borrowed from the bond markets. Until recently, politicians have treated the markets with contempt by enacting ever greater promises to the electorate without the markets apparently minding.

Comfortably Numb

In retrospect, it is clear that quantitative easing effectively severed the link between government spending and market prices. While inflation remained subdued this severance could be exploited. The incentive to do so was just too great. The problem of course is that holding interest rates at zero for an extended period was always going to have serious consequences. By removing the cost of capital and consciously boosting asset prices, one is deliberately encouraging poor capital allocation decisions.

If done for a short period the balance between stimulating activity without corrupting investment may be worthwhile. Over longer periods the effects become more pernicious. Decisions taken in an environment of free money become embedded in capital structures, business models, asset prices, including housing, and in government commitments. After all, prices in capital markets are not just a tool to be used by the authorities to stimulate demand, nor simply a yardstick to measure investment performance. They should be the means by which capital is allocated in the economy. Arguably this has not been the case for some time. Reality, or what used to be normality (before the days of zero interest rates), may be returning after 14 long years. It is the recent past which should be seen as the anomaly.

As each of these areas feels the renewed pressure of rising borrowing costs these effects go into reverse. Highly indebted businesses struggle, companies begin to prioritise cash flow over market share gains, asset prices, including housing, decline and governments are forced to be less profligate. Ultimately a recession is the result which is needed to bring demand back to a level that is consistent with stable prices. In this scenario it is likely we have seen some derating of equities from the rising discount rate (although even this, arguably, has further to run).

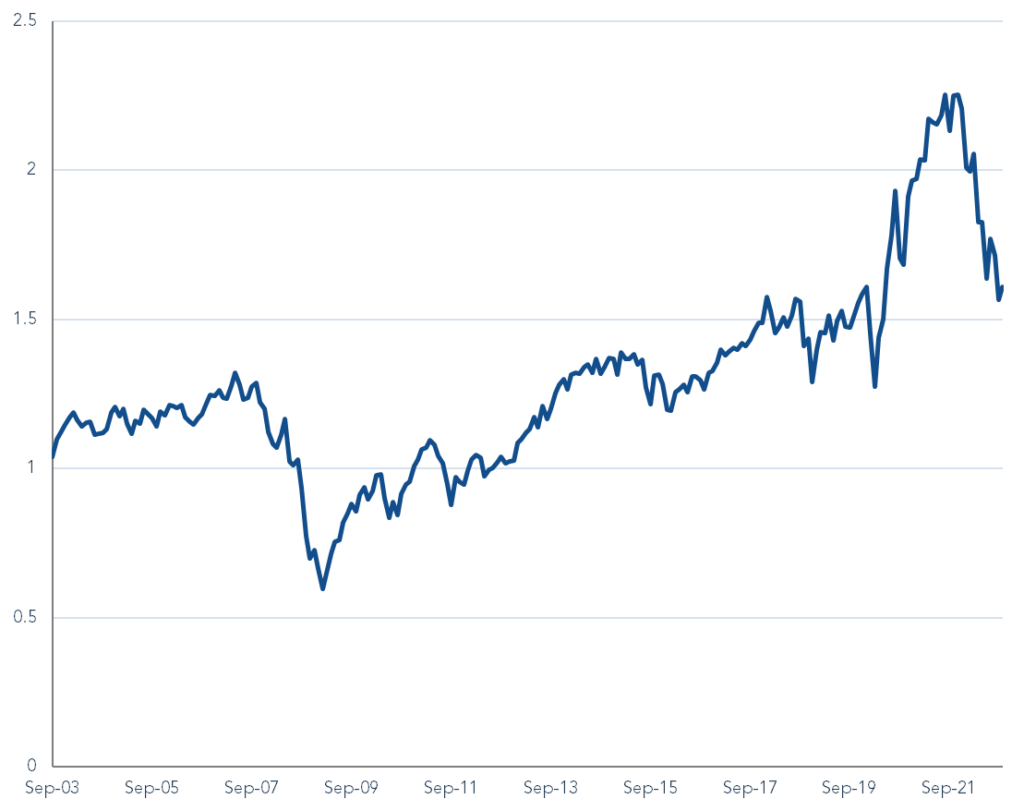

Figure 6: US Market Capitalisation/GDP

Source: Bloomberg, 24 October 2022.

However, it is likely we have yet to see the effects of declining earnings.

Figure 7: S&P 500 Index forward EPS and PE ratio*

Source: Bloomberg, 25th October 2022.*Rebased to 100. Earnings Per Share (EPS) is a company’s profit divided by the number of shares outstanding. Price-to-earnings (P/E) ratio is a valuation metric that compares a firm’s stock price to its earnings per share.

Another Brick in the Wall

In this environment we believe our quality-focussed, conservative and value conscious style of investing is appropriate as we seek to navigate the more difficult part of the economic cycle. By being highly selective about the companies in which we invest, with an emphasis on resilience and predictability, we aim to build an equity portfolio that is robust to a range of outcomes whilst continuing to deliver growing income to our investors.

By avoiding high degrees of cyclicality and capital intensity we aim to invest in companies that are relatively insulated from the problems we have highlighted in this report. Further our companies are generally conservatively financed protecting them from the rate shock we have seen. They also possess inherent competitive advantages that allow for sustainably high returns on capital derived from certain attributes. Examples include: 1) companies that have a predictability or persistency of demand from habitual repeat purchases supported by strong brands such as our consumer staples companies; 2) companies that are effectively software platforms which lead to a persistence of demand and high switching costs, such as Nintendo, CME and InterContinental Hotels; and 3) non-discretionary spending derived from needed products such as our healthcare investments.

It should be acknowledged that we have a limited exposure to REITs which have suffered. Even here we believe our companies represent decent value and reasonable leverage considering the valuation and defensiveness of the underlying assets. It seems likely to us that these assets have already priced in a very negative scenario whereas the broader market has yet to.

We remind our investors that we are not managing the portfolio according to an inflation forecast but aim to have companies that can cope whether inflation remains a problem or not. Having said this, it seems possible to us that inflation is peaking. Freight rates have collapsed, commodity prices have softened, supply chains are responding and demand is beginning to weaken. Until now our companies have been able to raise prices owing to the competitive advantages they enjoy. However, the pace at which input costs have been rising has led to a margin squeeze. If costs are now beginning to climb at a declining rate then today’s margin squeeze is tomorrow’s margin expansion. The portfolio should be well placed on this basis.

Alternatively, inflation will remain more elevated – an entirely plausible scenario. In this case the same competitive advantages that allow for sustainably high returns on capital should also allow our companies to raise prices to offset this inflation. It may take an extended period for this to become apparent, but allowing sufficient time for our companies to demonstrate their quality is a benefit of being long term investors with low turnover. We are not making investment decisions based on what is happening now but what we can reasonably expect to happen over years.

Similarly, we are being patient when considering reallocating capital in the portfolio. It remains the case, as it has been for a while, that we would like to have more of the portfolio invested in three key areas; consumer orientated assets, non-bank financial companies and select industrial businesses. In this vein Tomasz Boniek has recently completed a trip to the US to meet a range of industrial businesses some of which are in our investment universe.

Wish You Were Here

As travel restrictions worldwide are loosened, and face-to-face meetings become the norm, we have gone back to visiting our portfolio companies. In September, we travelled to the US, visiting four different regions in four days. American companies and management teams seem to look to the future with optimism. We always make an effort to spend time in the US as it stops us from being too bearish.

The theme of the trip was industrial businesses. The industrial sector contains a wide range of companies, most of which would not meet our stringent quality criteria. Below the surface, however, there are a small number of outstanding businesses. Disruption in many industrial markets is low. Sales cycles are long, and customers are risk averse, giving incumbents an almost insurmountable advantage. Moreover, industrial production will continue to increase gently through the cycle.

The result is a select group of companies that has incredibly high staying power. Provided that there is a sound capital allocation policy and prudent balance sheet structure, we can say something sensible on where these businesses’ earnings (and dividends) might be in the long term. These are precisely the type of companies we want to hold in our strategy as they provide a growing, sustainable income stream.

In our view Fastenal and Texas Instruments represent the most interesting, high quality and relevant companies for the strategy.

Nestled between rolling hills and the mighty Mississippi River, Winona (Minnesota) is the home of Fastenal. Fastenal is a US industrial distributor of fasteners, safety products and many other tools. We could write pages on what makes the business special, but culture has to be at the top of the list. In preparation for the trip, we read the book “The Power of Fastenal People” by Fastenal’s founder Robert Kierlin. Fastenal is a company with customers at its core, where simplicity, frugality and accountability are the guiding values.

During the full day we spent with the CEO and some of the management team, we felt ‘The Power of Fastenal People’. Simplicity and frugality allow the company to concentrate organisational and economic resources to serve customers. Accountability – branch and district managers have complete control over their local economics. This means business decisions are in tune with local market needs. People are promoted from within, and growth is predominantly organic. The CEO is incredibly ambitious, yet his ambition is first and foremost for the organisation and its purpose. We believe that unique cultures are rare, but in Fastenal, we found one of those unique corporate cultures that lead to exceptional returns for shareholders over time. We first invested in Fastenal in December 2020.

From the vast lands of Minnesota, we travelled down to sunny Dallas to meet with Texas Instruments (TI), a leader in analogue semiconductors. We have spent the last few years patiently building our semiconductor industry knowledge. At the risk of oversimplification, TI designs and manufactures relatively “simple” chips that don’t require the latest manufacturing technology and have incredibly long shelf lives. While other semiconductor companies, such as Intel, have to constantly design and manufacture new CPUs to satisfy the insatiable need for greater computing power, TI chips work for decades. We believe that roughly half of TI’s sales derive from chips designed more than ten years ago. The result is a business with little technological risk and relatively low capital intensity.

The semiconductor industry has a degree of cyclicality, however in the case of TI, we consider this risk to be mitigated by having a conservative balance sheet and capital allocation policy that rewards long-term shareholders. Indeed, we believe TI has one of the clearest frameworks for value creation, and we urge our readers to peruse the Investor Overview document on TI’s website. The business is fantastically profitable, ranking in the 89th percentile of S&P500 companies in terms of free cash flow margins.

We are sometimes asked whether trips to visit companies are useful. Can’t we cover more ground by meeting companies when they are in London? We think like business owners. If we were to buy the proverbial newsagent around the corner, we would of course visit the shop and talk to the owners. When we invest in a publicly listed company, we are buying the business, not trading the shares. Therefore, as business owners, one of our main responsibilities is to visit the companies we own. No amount of desk research produces the same insights one could gather from observing companies at their premises.

Despite the worsening economic outlook, our trip to the US gave us reasons for cautious optimism.

The companies we invest in are resilient and have the ability to thrive in almost all economic environments. In turn, this gives us visibility on the income generated at a portfolio level and some confidence that it will continue to increase on a constant currency basis.

Disclaimer

The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party. Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. Tax legislation and the levels of relief from taxation can change at any time. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training.© Troy Asset Management Limited 2023.